Techniques that help the various digital components, data, networks to get secure from uncredited digital access are cybersecurity. There are multiple ways to implement cyber security depending upon the kind of network you are connected to and the type of cyber-attacks you are prone to.

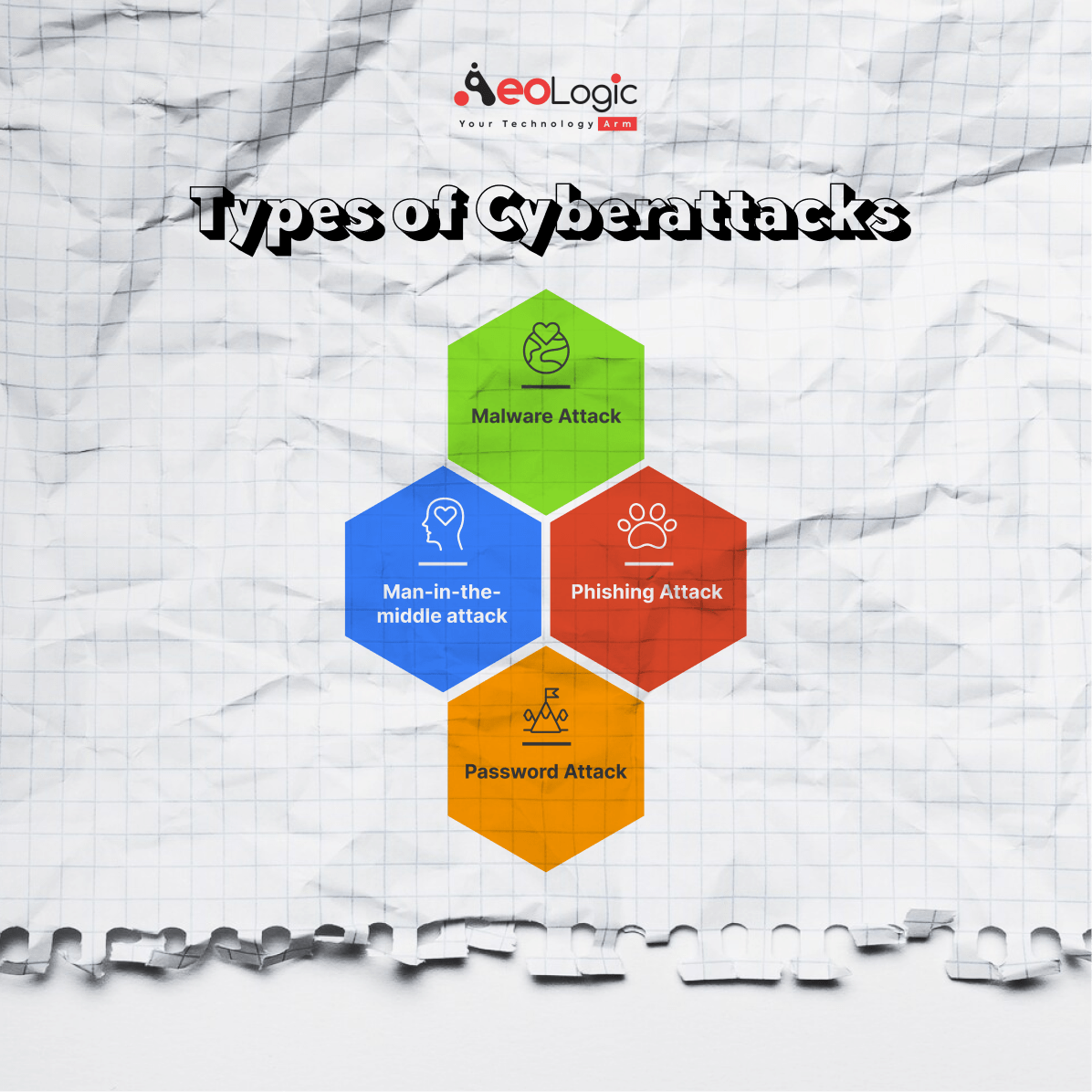

The Various Types of Cyberattacks:

1. Malware Attack:

One of the most common types of cyber security is a malware attack like trojan, adware, and spyware to name a few, if a user downloads any suspicious attachments online, their system could have to get corrupted by certain malicious viruses embedded within the attachments.

2. Phishing Attack:

A phishing attack is a cyber-attack in which a hacker usually sends fraudulent emails which appear to come from a legitimate source this is done to install malware or sensitive information like credit card numbers and login credentials could have also been stolen.

3. Man-in-the-middle attack:

Another type of attack is a man-in-the-middle attack here’s the hacker gaining access to the information path between the user device and the website server. The hacker’s computer takes over the user’s IP address by doing so the communication line between the user and the website is secretly interrupted this commonly happens with unsecured WiFi networks and also through malware.

4. Password Attack:

It is one of the easiest ways to hack a system. Here’s the user’s password could have been cracked by using either a common password or trying all possible alphabetical combinations.

Importance of Cyber security:

A major reason why cybersecurity jobs are in demand is the various types of cybersecurity threats that challenge banking technology.

Also, the use of cybersecurity provides gravity in banking in the following ways:

1. The bank reputation:

In today’s world, things are going cashless, people prefer to use e-cards, digital money over the traditional way of doing transactions. The cyberattack will cause in loss of public trust and a sense of security in the bank in this context, organizations tend to cause colossal damage to their reputation even if a single weak link happens in the cybersecurity of banking technology. Hence having a good cybersecurity team and technology is a must for a bank.

In addition to this, customers should also get updated by the bank on the types of cyberattacks and how to be safe from them.

2. The value of money and time of the customer:

Even a small rift in the bank’s cybersecurity is capable of causing enough chaos in the lives of both bank and its customers. On one hand, customers would have lost their personal and valuable data and on the other hand, they have to undergo stressful and time-consuming steps to recover the data.

Banks need to perform certain steps like canceling the cards, checking statements, etc.

3. Data security of the customers:

In the past world has seen plenty of fraudulent cases which leads to giving the customers many sleepless nights after their confidential data have been used in crimes.

Cybersecurity enables the data of the bank’s customers to be secure and to give no need to be scare assurance. Get in touch with our big data analytics solutions to know more.

4. RBI’s security guidelines:

RBI has certain guidelines on which banks are abode to follow cybersecurity guidelines are one of those. For non-compliance banks will be penalized in 2018 Indian banks paid a penalty of 10 million for adhering to the RBI’s cyber security guidelines.

5. Securing Data:

We are living in a digital era in which people prefer to do even their basic day-to-day activities online whether it will be online shopping, different types of online bookings, ordering eatables, online banking, etc because of this people are more open to the world hackers hence their personal data from the bank can be misused if it gets hacked.

The banking technology should be prominent especially when it comes to cyber threats to protect their customers as well as their own data from getting hacked.

Conclusion:

To conclude we say that cybersecurity is the most essential technology for banking especially in today’s world it serves tons of benefits and enables smooth banking functionalities.