?Credit scoring and loan approvals are major aspects of the finance industry. Digital lending is another aspect, as the digital lending market is growing rapidly. The Digital Lending Market size is estimated at USD 453.32 billion in 2024 and is expected to reach USD 795.34 billion by 2029, growing at a CAGR of 11.90% during the forecast period (2024-2029).

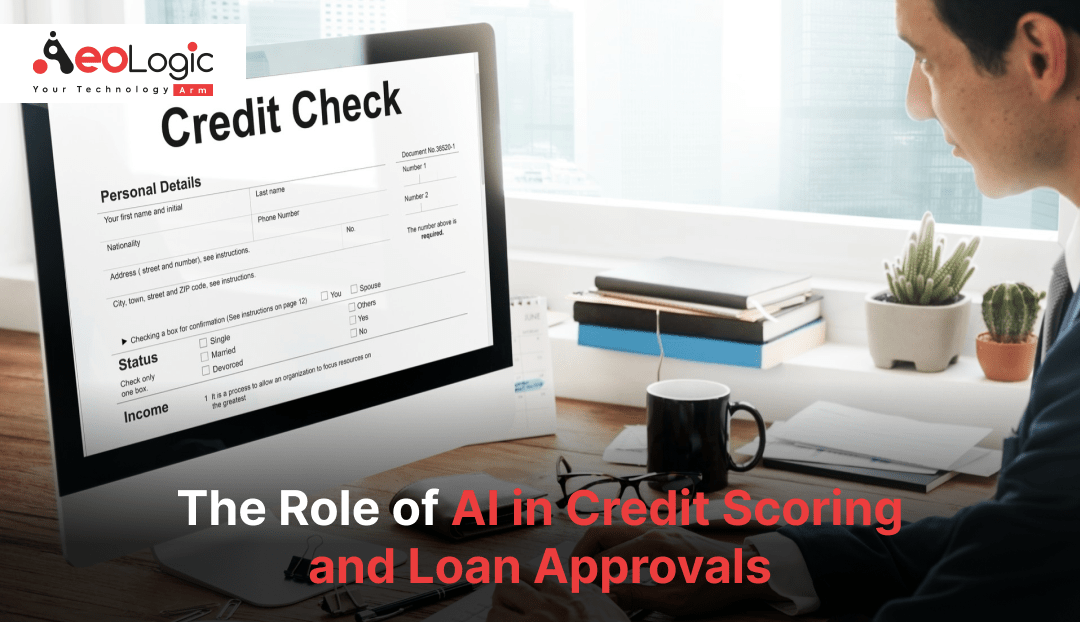

What is Credit Scoring?

Credit scoring refers to a numerical expression that shows how much a person is worthy to take credit for any specific purchases. There is a maximum point and much near that point refers to a good credit score. Loan approvals are another finance-related aspect that is in trend as there are different types of loans for other interests like education loans, home loans, personal loans, etc. Personal loans are one of the highest categories of loan takers as America is one of the major countries in this matter. Nearly 23 million Americans have unsecured personal loans, with an average balance of about $11,500. Today, the average interest rate on a personal loan is 11.48%, up from 9.38% in 2021.

Loan approval is not an easy task as it takes a lot of processes and time to approve. The normal person faces various issues for loan approvals and makes many rounds to the banks. Where conventional credit scoring is generally based on past credit history and this is not fair at a certain point. There could be many errors that cannot be detected and prove bad for credit scoring. Low credit score creates a lot of problems a few times and this can be avoided with evolution in credit scoring method. There is a lot of technology that has been integrated into the financial sector and AI is one of them. By 2025, the global AI in the financial market is projected to reach $26.67 billion. 69% of banks are already using AI for data analysis and improving customer service.

How AI Enhances Credit Repair and Loan Approval?

By rapidly spotting mistakes, inconsistencies, or inconsistencies in your credit reports, automating the creation of dispute letters to bureaus in response to errors found, and continuously monitoring changes in your credit report, custom ai solution can significantly aid in credit repair. Where financial organizations can now automate the acceptance of loan applications using artificial intelligence (AI), resulting in quicker, more accurate, and more efficient credit determinations. These aspects can be enhanced through the proper use of AI in the financial sector.

In this article, we will focus on the role of AI in enhancing credit scoring and loan approvals. We will also see some other additional details like benefits, and challenges and lastly, we will conclude this topic.

What Is AI In Credit Scoring And Loan Approvals?

AI plays an important role in fast and easy loan approvals for people as they can fulfill their needs as soon as possible. For people who are too dependent on credit cards, this is also important to maintain their credit card scoring at a good number. Incoming credit applications can be evaluated by AI algorithms based on predetermined standards, such as risk factors, income, and credit history. Financial organizations can expedite loan approval by making quick credit determinations through automation of this procedure.

Also Read: Artificial Intelligence Solutions in Different Industries

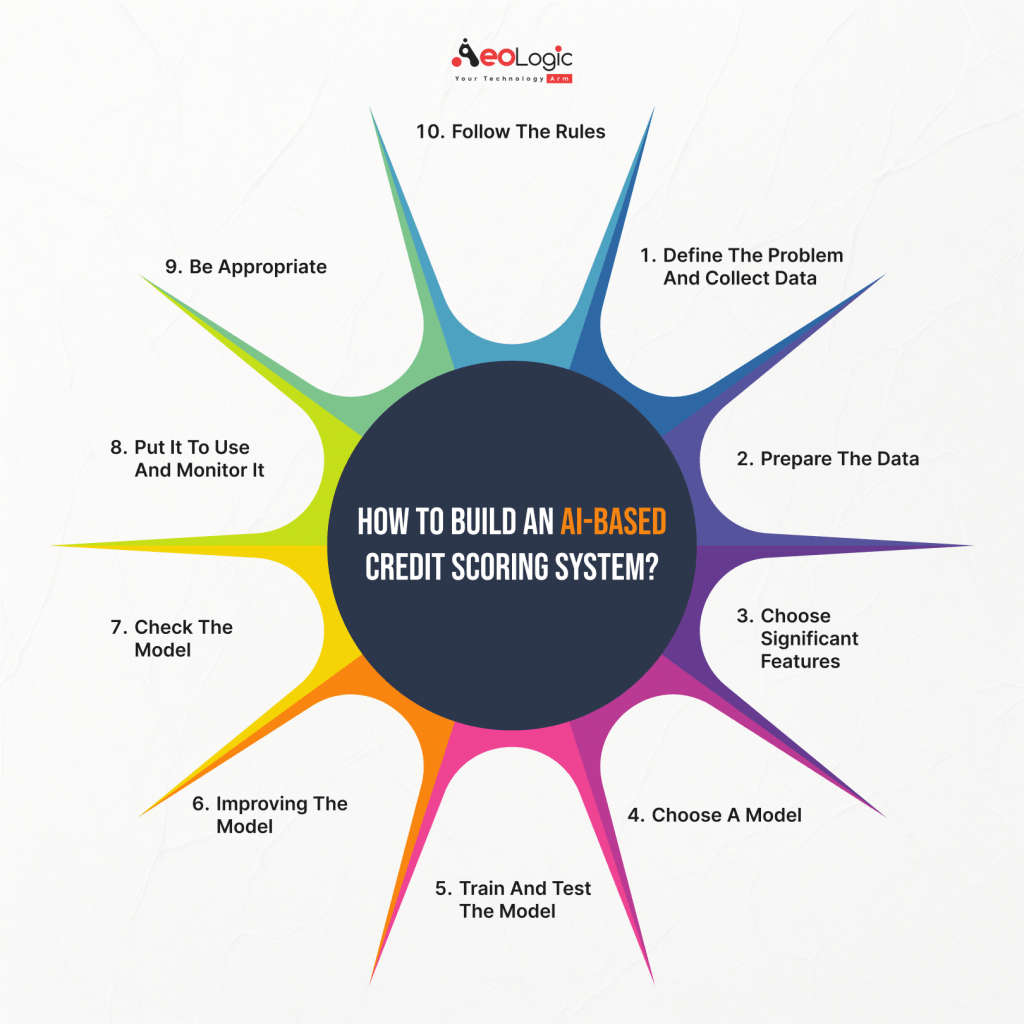

How to Build an AI-Based Credit Scoring System?

Creating a good credit scoring system with AI requires a few key steps and things to think about. Here’s a simple guide to how it works:

Step 1. Define the problem and collect data:

Clearly identify the problem you hope to tackle with the credit scoring system. Determine the characteristics you want to include in your scoring model, such as income, employment history, and credit history. Collect pertinent information from a variety of sources, including credit bureaus, financial institutions, and public records.

Step 2. Prepare the data

Clean up the data you have gathered. Fill in missing information, correct errors, and convert categories to numbers.

Step 3. Choose significant Features

Examine your data and select the most significant factors that will help with credit rating. You can also generate new information from existing data to identify useful patterns.

Step 4. Choose a model

Choose the appropriate AI tool for credit scoring. Popular algorithms include logistic regression, decision trees, random forests, and neural networks. Consider how simple it is to grasp, how effectively it functions, and how intricate it is.

Step 5. Train and test the model

Divide your data into two parts: training and testing. Train the model on the first component, then evaluate its performance on the second half using simple metrics such as accuracy or precision.

Step 6. Improving the Model

Change the settings to make the model better. You can attempt several methods to find the finest ones.

Step 7. Check the model

Divide your data into smaller chunks and test it on various portions. This allows you to see how well it performs with new data.

Step 8. Put It to Use and Monitor It

Once the model is completed, begin using it. Keep monitoring how well it works and updating it as needed to ensure accuracy.

Step 9. Be Appropriate

Ensure that your credit score method is unbiased. Check it frequently and resolve any issues.

Step 10. Follow the Rules

Make sure your credit score system complies with the law, particularly when it comes to privacy.

Creating a successful credit scoring system involves careful planning and constant monitoring. In addition, seeking assistance from specialists can be beneficial. A technical partner like Aeologic Technologies can assist in the system’s development and improvement, as well as ensuring its proper operation. Having the appropriate partner can save time, increase quality, and accelerate progress.

Benefits of AI In Credit Scoring And Loan Approvals

There are a lot of benefits of AI in credit scoring and loan approvals as it can enhance these departments. Here are a few key benefits mentioned below.

1) Risk Management and Portfolio Analysis with the AI

This is very important to timely analyze a portfolio as this gives an idea of progress for the financial organization. Advanced analytics are incorporated into risk management and portfolio analysis through AI-based credit rating models. They let financial organizations analyze risk exposures in their loan portfolios more quickly and accurately by processing massive volumes of data at rapid rates.

2) Credit Score Simulation

Many credit card users have no idea of how credit scoring works. Where AI can give them a proper idea of every what-if scenario as they pay down debt or close a credit card, might impact their credit scores. This helps to provide users with better financial literacy and a well-responsible credit card user. This overall enables better credit card scoring by which users can get many offers and use cases of credit cards.

Also Read: How Are Automation and Robotics Will Impact Your Employment

3) Faster Loan Processing

Loan processing is a very long process that takes a lot of time for customers. The whole loan procedure can be automated and streamlined with AI. Artificial intelligence (AI)-powered systems can assess loan applications, extract pertinent information, and verify documents through natural language processing (NLP) and machine learning. This reduces the time and effort required for manual processing. This overall increases the efficiency of loan approvals.

4) Fraud Detection

There are a lot of frauds happening regularly around the world in the finance industry. This affects the lenders directly or indirectly. Artificial intelligence-based systems can improve overall lending process risk and assist lenders in making better-informed decisions about loan approvals. Because risk assessment is now more accurate, lenders can give loans to those who were previously thought to be too dangerous.

5) Personalized Loan Offerings

This can be a difficult task for banks to provide loans according to people’s needs and their capability to repay them. Where AI algorithms can evaluate each person’s financial information and usage patterns. AI can recommend loan products that are suited to a person’s needs and financial situation by taking into account variables like income, spending habits, and financial objectives.

Also Read: Transforming Businesses with AI Automation Solutions

Challenges With AI In Credit Scoring And Loan Approvals

We have seen some potential benefits of AI in credit scoring and loan approvals. But there could be some potential challenges too as there are a few mentioned below.

- Vulnerability in data quality can be a challenge for AI in the finance industry. This can create non accurate results that could result in loss for the industry.

- Data security and privacy are always a risky factor with AI as loans, credit cards, etc deal with the most sensible data. There is always a high chance of getting cyberattacks.

- The high implementation cost of AI can be a challenge for small banks. This restricts the full use of AI’s potential to enhance aspects of the banking industry.

Also Read: Artificial Intelligence Solutions to Enhance Your Business

Final Words

We have seen many details on AI’s impact on credit scoring and loan approvals. This can conclude that the financial landscape has seen a substantial transformation with the integration of AI in credit scoring and loan approval algorithms. Artificial intelligence is changing the way we assess borrowers’ creditworthiness because of its sophisticated analytical skills and capacity to handle enormous volumes of data. Traditional methods lack the precision and sophistication that artificial intelligence (AI) technology brings. This technology is enhancing the future as well as securing the future of the finance industry. A new era of financial inclusion and accuracy is being ushered in by the ongoing evolution and boundless potential.

You can start today by contacting us!

I’m Deepika Pandey, an SEO strategist and content writer with 6+ years of experience. I create SEO-friendly content that drives traffic and engages readers. I combine data insights with creativity to help businesses grow their online presence effectively.