The finance sector or industry is growing and contributing to providing services related to financial aspects for the citizens. Simply a segment of the economy known as the financial sector is made up of businesses and establishments that offer retail and commercial clients financial services. This industry group includes a wide range of businesses, such as banks, real estate firms, insurance organizations, and investment corporations. This sector has established a well-known global market size as the financial services market size has grown strongly in recent years. It will grow from $31138.82 billion in 2023 to $33539.52 billion in 2024 at a compound annual growth rate (CAGR) of 7.7%.

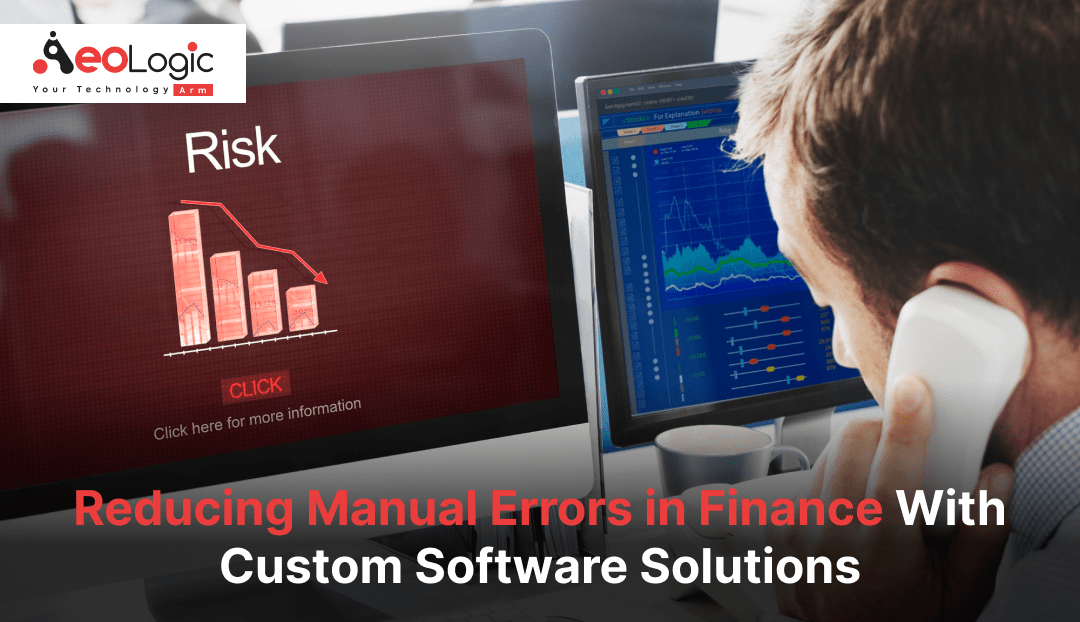

As this industry is very sensitive, small mistakes or lack of concentration could damage a lot at different stages. According to studies, mistakes made during manual data entry can happen up to once every 100 keystrokes. In the world of high finance, a simple comma can change the meaning of an instruction entirely. This margin of error is intolerable. Manual data entry is the main cause of mistakes or errors that sometimes result in big losses for the finance industry.

To avoid or reduce manual errors in the finance industry, it needs to implement some kind of technology that must have the ability to resolve error-related issues and help to increase the efficiency of the finance industry. Custom software solutions development could be the best solution for this issue in the finance industry. Automation of repetitive tasks, error detections, real-time operating, data analysis, forecasting capabilities, etc could improve the finance sector and its manual error rate. Custom software solutions has also a well global market size as the global custom software development market size was estimated at USD 35.42 billion in 2023and it is projected to grow at a CAGR of 22.5% from 2024 to 2030. These stats show that this solution is not new as many industries have implemented it and are getting a lot of benefits from it.

In this article, we will focus on the role of custom software solutions in finance for reducing manual errors. We will see various aspects like benefits, challenges, and conclusion of custom software solutions for the finance industry.

What Are Custom Software Solutions In Finance?

Generally, Custom software solutions in business are created with the needs of a particular company in mind, offering a customized solution that complements its own goals and procedures. In the finance industry, there are complex calculations and they are mostly done by human employees. There is always a high chance of making mistakes and this could have a big adverse impact on the company. A custom software solution can be developed for calculations, analysis, error detection, forecasting, etc that reduces manual labor as well as error rate. This can help to enhance the efficiency and productivity of the finance industry.

We have listed: Top App Development Companies

How Can Custom Software Solutions Reduce Manual Errors In Finance?

With a custom software solution for the finance sector, taxes, profit margin calculations, and spending summing are just a few of the financial chores that can be handled automatically. The software reduces the possibility of errors brought on by manual arithmetic or formula errors by automating these computations. Suppose an employee is doing a calculation and suddenly someone calls him/her then this could create an interruption in calculation and there is a high chance of getting miscalculation. Since humans are lazy, so many things are not recalculated. Where software cannot be disturbed or miscalculated and also do the tasks many times faster than employees. This almost reduces the error rate of manual error in the finance industry. There are many other benefits that we will see later in the upcoming paragraph.

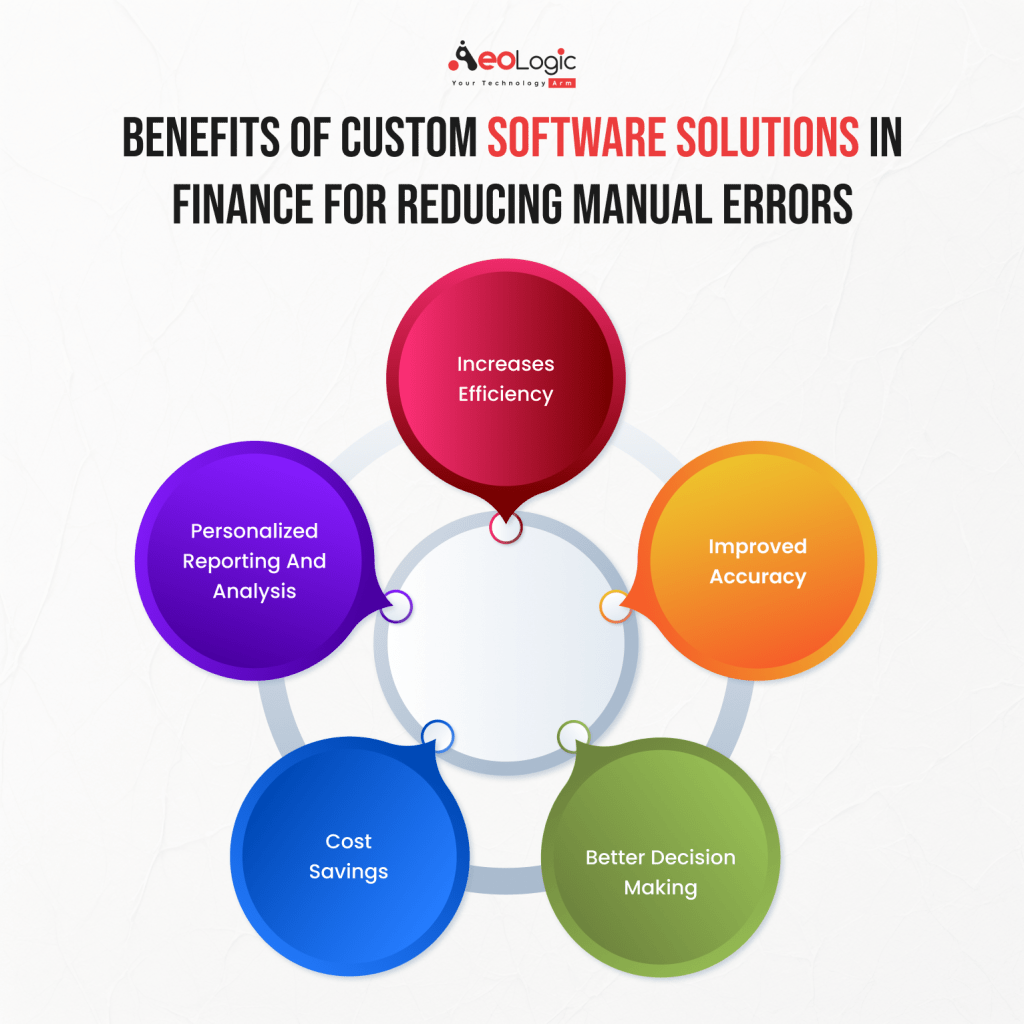

Benefits Of Custom Software Solutions In Finance For Reducing Manual Errors

There are a lot of benefits of custom software solutions in the finance industry for reducing manual errors. Here are a few key benefits mentioned below.

Increases Efficiency

Some repetitive tasks or calculations take too much time to do manually. Your team may work more productively and concentrate on high-value projects by using software solutions to automate monotonous chores and streamline processes. This maintains the workflow at a faster and more accurate pace. This increases the efficiency and productivity of the company.

Improved Accuracy

Errors can occur in manual operations, which can be expensive for companies. Errors can be reduced and precise data entry and analysis can be guaranteed with the use of software solutions. There could be software developed that specifically can perform calculations, analysis, and error detection. This overall improved the accuracy and reduced the error rate for the finance company.

Better Decision Making

Decision-making is one of the important aspects of a finance industry as a wrong decision could result in loss for the company. Decision-making should be based on insights and data which cannot be possible without any proper tools. Where a custom software solution like AI integrated can provide valuable insights and reporting for strategic planning. This improved decision-making ability and can prove beneficial for the company.

Cost Savings

As mentioned earlier, many processes in the finance industry are repetitive and prone to errors when done manually. Apart from the risk of errors, these processes also incur high operational costs. By opting for custom software development solutions, you can automate these repetitive tasks, eliminating the need for manual processes and significantly reducing operational costs. This approach not only lowers the error rate but also maximizes ROI by streamlining operations and cutting unnecessary expenses.

Personalized Reporting and Analysis

Businesses can generate customized reports and analytical tools that are tailored to their unique requirements with the help of custom financial software solutions. Accounting teams can now produce insights and make data-driven decisions that propel company expansion thanks to this. Businesses may make well-informed strategic decisions and obtain a deeper insight into their financial performance with the help of real-time analytics and configurable dashboards.

Also Read: Benefits of Financial Automation Software For Banking

Challenges With Custom Software Solutions

There are a lot of challenges with the custom software solutions as here are a few mentioned below.

- A custom software solutions development could be costly and take time to build. Many small finance companies cannot afford it so it could be a challenge for many.

- Time loss could be another challenge with custom software development as it takes too much time to gather information.

- This is a hard task to find the right vendor for custom software development for a specific function in the finance sector. One should be very careful while developing software as this industry has no place for any error. So this could also be a challenge.

Related Blog: Custom Kiosk Software Development Solutions For Healthcare Industry

Final Words

Accounting operations are being revolutionized by custom financial software solutions that improve security, accuracy, and efficiency. Finance businesses can enhance their financial operations and growth by automating repetitive procedures, offering customized reporting and analysis tools, integrating with current systems, and guaranteeing adherence to industry regulations. Businesses can streamline their accounting processes and maintain their competitive edge in the current business environment by implementing the appropriate custom software solution with Aeologic Technologies. Overall, this tool can be a reason for the evolution of the finance industry in the upcoming years as it can increase productivity, efficiency, and accuracy in the finance industry.