Banks are the most important thing in managing the whole world’s finance-related issues and work on almost everything including money. Banks are the main pillar of the world economy. In this digital age, banks are also undergoing digital transformation and it is necessary to move with technical transformation. The statistics show that the Digital Banking market’s projected Net Interest Income worldwide is set to reach US$131.80bn in 2024. Looking ahead, it is expected that the Net Interest Income will display an annual growth rate (CAGR 2024-2028) of 4.09%, leading to a market volume of US$154.70bn by 2028.

But some many places or nations are too far from getting a digital transformation for their banking. This is very necessary to make digital transformation in banking for every nation. This article could be helpful to provide information about the benefits of digital transformation in banking to the world. We will also discuss many other details about the digital transformation in banking as examples, future, challenges, etc.

Digital Transformation in Banking

Digital transformation refers to the process of using digital technologies to transform existing traditional and non-digital business processes and services, or creating new ones, to meet the evolving market and customer expectations. When we discuss “digital transformation” in banking, it means the process of integrating contemporary technologies into many aspects of a bank’s operations to enhance client satisfaction, boost productivity, cut expenses, etc.

Also Read: Benefits of Digital Transformation for Small Businesses

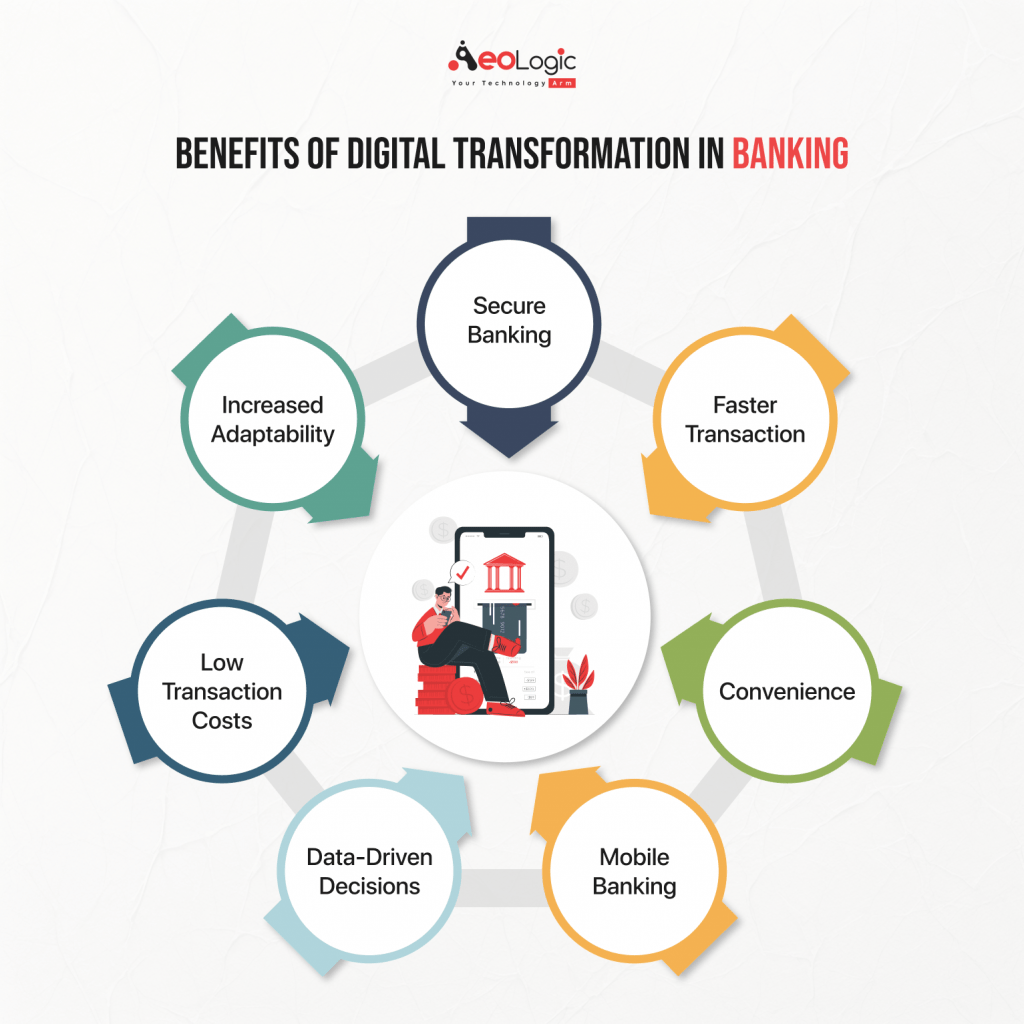

Benefits of Digital Transformation in Banking

Digital transformation in banking offers many advantages for banks and customers too as banks can tailor their services according to customers’ needs. Digital transformation enables data analysis and understanding of customer behavior with digital tools so that banks can offer personalized recommendations and targeted offers to enhance the overall customer experience. Digital banking also enables banks to take services from banks via homes without any hustle in the queue. This also provides fast processing of processes that take many days via manually in banks.

Digital transformation in banking offers many benefits as there are a few benefits mentioned below.

Secure Banking

Digital transformation in banking enables more security to finance as there will be alert messages on registered mobile numbers if there is any fraud detection in the account. If there is any fraud without your mistake then it will be totally bank responsibility and they will pay you back.

Faster Transaction

A few years back. To transfer money to another account needs to go to the bank and have to wait for hours in line but with digital banking, transactions are possible second with appropriate devices. This saves your time and is also beneficial for those who can’t access digital banking as they do not need to waste hours in long lines.

Convenience

Digital transformation in banking also enables a convenient method of banking as you can manage your funds from anywhere, anytime from your comfort zone. This increases efficiency and saves you valuable time.

Mobile Banking

Mobile banking is one of the most beneficial things of the digital transformation in banking as almost everyone has mobile phones that allow them to make bill payments, transfer funds, access their account, etc anytime.

Data-Driven Decisions

The more information a management team can gather, the more confidently they can make sound judgments. The most important decisions are data-driven, and digitalization enables financial institutions to make difficult (but educated) decisions based on precise and real-time data that best fulfills consumer needs.

Low Transaction Costs

Digital transformation encourages long-term cost savings by needing less continuing financial investments than traditional money exchange methods. For example, digitalization has made online, cashless transactions more accessible and simple, saving money on intermediary channels that transport physical cash from one party to another.

Increased Adaptability and Flexibility

Mergers and acquisitions are becoming increasingly typical in the banking and financial services industries. Historically, joining organizations with different physical systems has resulted in compatibility concerns, which frequently cause turmoil for both IT departments in question. However, cloud-based solutions eliminate the need for on-site systems, resulting in a more seamless digital consolidation of company units.

Examples of Digital Transformation in Banking

There are many use cases or examples of digital transformation in banking as here are a few examples mentioned below.

Robotic Process Automation(RPA) in Banking

Robotic process automation in banking is one of the most important use case examples as it helps banks & financial institutions increase their productivity by engaging customers in real time and leveraging the immense benefits of robots. RPA can be used in customer service to deal with customer concerns within a very short time and standard inquiries can be processed quickly and efficiently.

Cloud Computing in Banking

Cloud computing is another use case example of digital transformation in banking as it allows Banks to easily access an API ecosystem and robust data management capabilities. The platforms are designed to enhance staff satisfaction and foster stronger client relationships and banks are also driven by the cloud to seize total control of the entire facility.

Blockchain Technology in Banking

Blockchain technology is another example of digital transformation that allows a distributed ledger system that operates decentralized and facilitates safe and transparent transactions between two parties without any third-party involvement. A list of transactions is contained in each of the connecting blocks that make up the ledger.

Also Read: Major Challenges of Digital Transformation in Manufacturing

Challenges with Digital Transformation in Banking

Surely digital transformation in banking offers a lot of benefits and use cases but also there are some challenges with digital transformation. Here are a few challenges mentioned below.

- Frauding is a major challenge of digital banking as a person who does not have proper knowledge can easily be trapped by cyberattackers. Many frauds are happening by just clicking on a link so it is a concern with digital transformation.

- Over-dependability on online transactions could be a concern as today’s generation does not like to carry cash. But sometimes any issue in the bank server does not allow payment. This could be a serious concern in an emergency.

- Third-party banking apps charge too much commission to make transactions of funds which could be a concern for some customers.

Also Read: Role of Digital Transformation in Automotive Industry

Final Words

Digital transformation is not an option as it is necessary for modern-day banking and large finance institutions to maintain balance with the growing world. With digital technologies and tools, banks can improve many aspects of banking as customer experience, optimize operational processes, and adapt their services to meet modern customers’ demands. Overall, digital transformation could be the best thing to enhance the banking industry and most convenient for customers.