The banking industry is one of the vital industries as it manages the finances of people, and organizations and provides loans to the needy ones at a good interest rate. It is safe to say that, the banking industry is one of the main pillars of world GDP. The banking industry includes systems of financial institutions called banks that help people store and use their money. But like every sector, the banking industry is also affected by frauds that can be of various types. It can be fraud in the transaction of money via the wrong way or getting money in illegal ways etc. This overall hurts the world’s economy. The past few years stats show that the number of frauds reported by banks has gone up from 7,263 in 2020-21 to 13,576 in 2022-23. The amount involved in these frauds has seen a significant decline from Rs 1,18,417 crore to Rs 26,632 crore during the same period.

We need to stop the frauds to make a better world and make people trust banks to keep their finances in banks. However, this is not easy to detect and prevent fraud by the bank employees. There is a need for technology that can prevent fraud and cloud-based solutions can be that. In this article, we will see in detail the importance and role of cloud-based fraud prevention solutions for the banking industry. Also, we will go through the additional details that could be very important to know.

What are Cloud-Based Fraud Prevention Solutions?

Cloud-based fraud prevention solutions can continuously learn from and adjust to new fraud tendencies by utilizing machine learning (ML) and artificial intelligence (AI) capabilities. To keep ahead of changing threats, these systems examine past data, spot trends, and update fraud detection algorithms. In banking, this technology analyzes past fraud records with the help of AI and matches the present data patterns. If something is doubtful then it makes an alert as soon as possible. This can make people aware and prevent fraud. Since it is cloud-based technology then it has a lot of storage to store data from the past and in the future too so it can extract data of any data, month or year in seconds.

How does Technology Work to Prevent Fraud in the Banking Industry?

The working cloud-based fraud prevention solutions are simple as preventing these frauds requires the application of artificial intelligence (AI) given the large number of transactions banks perform daily, AI-based fraud monitoring systems must be able to absorb and parse vast amounts of data to detect fraudulent behavior in real-time. Overall, this technology is mostly artificial intelligence. In the future, this could be more developed by the integration of other technologies too.

Also Read: The Role of Cloud Computing in Scaling Industrial Opеrations

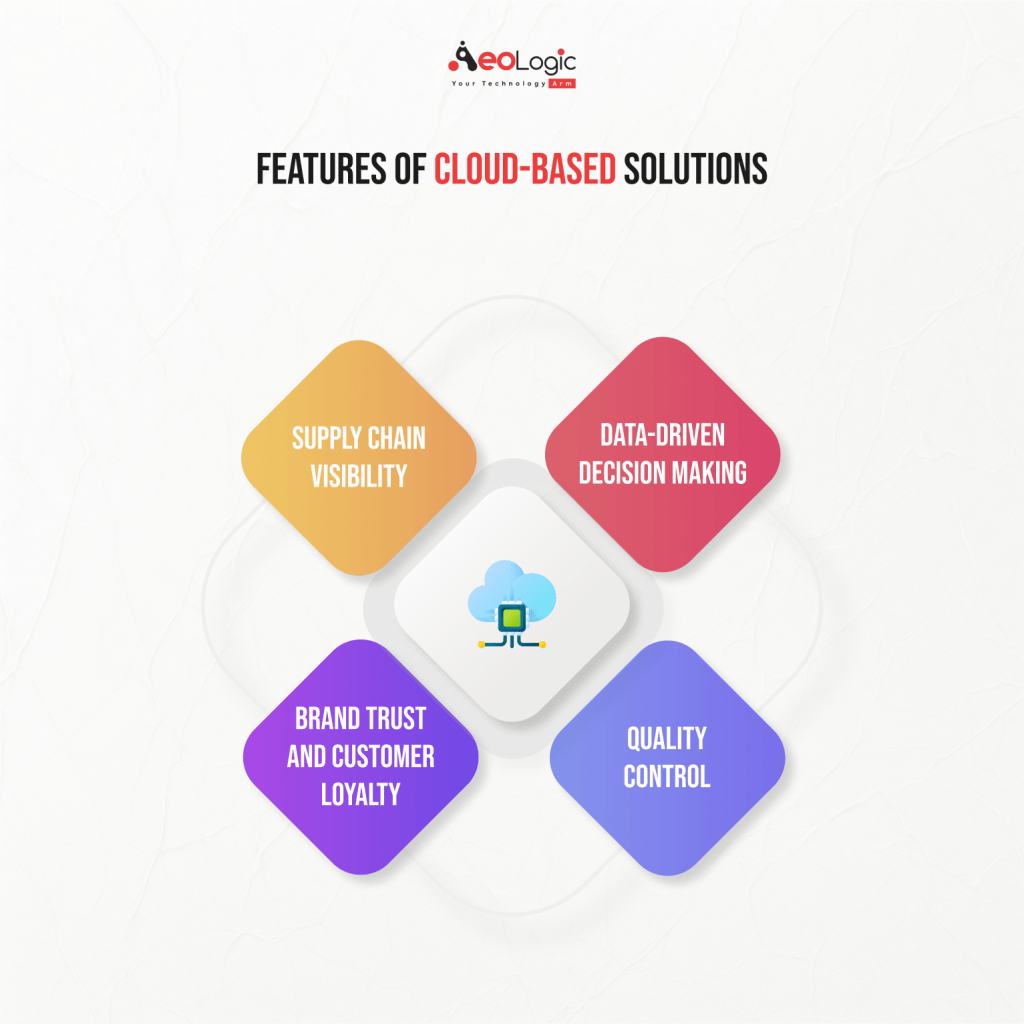

Features of Cloud-Based Solutions

Cloud-based fraud prevention solutions have some impressive characteristics as here are a few key features or characteristics mentioned below.

Resilience

Resilience refers to how quickly servers, databases, and network systems restart and recover from any loss or damage. Cloud-based solutions have the feature of resilience as any damage can be recovered in the least time.

Flexibility

Another feature of cloud-based solutions is flexibility as users can access their files via smartphones and laptops. This enables the users to access the files in any emergency as there is no need for any specific device.

Cost Efficiency

By using cloud infrastructure, you don’t have to spend huge amounts of money on purchasing and maintaining equipment. This enhances the cost efficiency and also provides the best services that overall increase the organization’s productivity.

Automation

Automation is one of the prior features of cloud-based solutions as this allows the system to automatically update, reboot, and upload. This reduces the time to manage the updates so that employees can work on other complex tasks.

Also Read: How Cloud Computing Transforms the Design Industry

Benefits of Cloud-Based Fraud Prevention Solutions for Banking Industry

We have seen the above-mentioned feature of cloud-based fraud prevention solutions that offer a lot of benefits in the banking industry. Here are some benefits mentioned below.

Tightened Security

As cloud-based fraud prevention solutions have the ability of machine learning algorithms that strengthen the security of banking. Artificial intelligence provides an advanced security layer that saves security breaches.

Better Customer Management

As with the better security and safe environment of the banks with the help of cloud-based technology, it increases the trust of customers on banks. This allows banks to also manage customers better as they know that they are safe to keep customers financed.

Early Detection of Fraud

Artificial intelligence technology can analyze past data that can be used for early detection of fraud. AI can analyze the pattern and alert the bank if any risk factor is detected. This prevents further losses too.

Reduces Financial Costs

With a pay-as-you-go pricing model, cloud computing lets financial institutions lower their data storage costs instead of having to pay a lot of money up front to set up and run large on-premise systems.

Cloud providers take care of managing and maintaining data storage services, which means your company doesn’t have to hire as many IT staff or buy as much equipment.

Challenges with Cloud-Based Fraud Prevention Solutions

With the many benefits and passive features, there are also some challenges too. Here are a few challenges mentioned below.

- Integration with the existing system can be challenging as it is a little bit complex to adapt the existing system to the cloud-based technology. Most banks have very old technology to manage funds so it is a concerning thing.

- Too much data overload can be a concern too. Cloud-based systems can store a lot of data but are almost extinct. If the data uploads in vast amounts then it can be a case of overload.

- Initial implementation cost can be an issue for some private banks as they are very small in net worth and cannot afford this technology.

Also Read: The Role of Cloud Computing in Mobile App Development

Final Words

Banks need to use cloud-based fraud detection and prevention technologies to strengthen their security protocols, promote confidence, and protect themselves from fraudulent activity. This not only enhances the banking industry but also makes normal citizens feel safe about their money. Every bank and finance organization should implement this technology to reduce fraud and use money in the right way to develop the world.

I’m Deepika Pandey, an SEO strategist and content writer with 6+ years of experience. I create SEO-friendly content that drives traffic and engages readers. I combine data insights with creativity to help businesses grow their online presence effectively.