The banking industry is always a significant industry for the development of the world in financial aspects. Banks depend on customers, as customer experience matters the most. If they are not able to provide a better experience, then customers will move to other options, which results in the loss of the banking industry. The commercial banking market is expected to grow from $3,355.63 billion in 2023 to $3,841.58 billion in 2024. The open banking market is expected to grow from $24.67 billion in 2023 to $31.01 billion in 2024.

Many conventional manners can enhance customer experience, like one-to-one interaction, answering their queries, providing them details by the employees, etc. But in this advanced world, there is also a need for changes with advancement that only comes with modern technology. AI-powered chatbots can be the tools or solutions that can enhance the engagement of the banking industry toward customers in more incredible ways than ever. AI-powered chatbots have been implemented by various industries, and they are getting incredible results. The global chatbot market is valued at $15.57 billion in 2024. By 2029, the global chatbot market will grow to $46.64 billion. More than 987 million people use AI chatbots today. The cost to develop and implement a chatbot can range between $5,000 and $500,000, depending on complexity, industry, and use case.

The Role of AI-Powered Chatbots in Transforming Banking Customer Experience

AI chatbots can enhance the customer experience in the banking sector by various means, as unlike human employees, they can solve or answer customer queries during non-working hours, can be more scalable than humans, offer proper information on the basis of data analysis, enable personalization, and provide automatic banking processes to make faster services and fraud detection, etc. These benefits can enhance the trust of customers in banking organizations, which is fully a beneficial thing for the banking industry. There are many banking regions that have been using or testing AI, as the global artificial intelligence in banking market size was estimated at USD 19.87 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 31.8% from 2024 to 2030.

In this article, we will see the role of AI-powered chatbots in the banking industry for enhancing customer experience. We will also see brief details about the benefits and challenges. In the end, we will sum up the whole discussion with a few final words that help to review all details in short.

Also Read: AI Chatbots Solutions for Customer Service Automation

Importance of AI-Powered Chatbots in Banking

AI-powered chatbots are so incredible as they can be used in the banking industry to enhance various aspects. If we talk about enhancing customer experience, artificial intelligence (AI) chatbots provide real-time answers to consumer questions without requiring human participation. They can quickly address routine questions because of their automated and effective nature, which improves client satisfaction. Customers’ trust can be increased by using chatbots to swiftly resolve queries. Additionally, they are capable of managing delicate issues like late payments without any human intervention.

Also Read: Role of OpenAI’s Chatbot ChatGPT for business Success

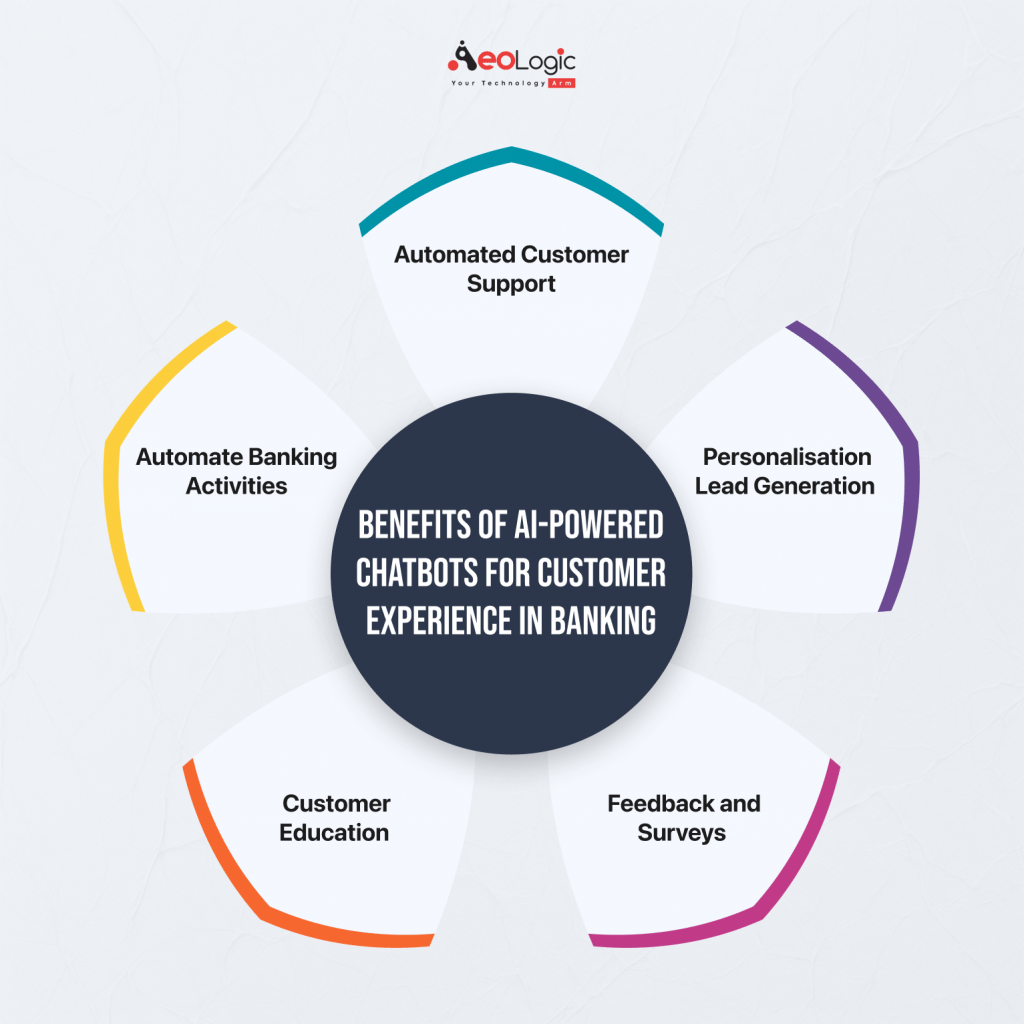

Benefits of AI-Powered Chatbots for Customer Experience in Banking

Every technology has its beneficial and non-beneficial sides, and so do AI chatbots. First, we are going to see beneficial aspects that can be gained by implementing it in the banking industry. Here are a few benefits mentioned below.

1) Automated customer support

Automated customer support is an incredible quality of AI chatbots for customers in the banking sector. AI chatbots are generally trained in natural process language that makes them able to understand the queries of humans and answer their queries without any human intervention. The most interesting part is that one can get an answer any time. For example, if a customer wants to know his/her transaction details, like statements, last balance, etc., late at night, then he/she just needs to enter the prompt, and there are details available.

2) Personalization through lead generation

Personalization is always the aspect that feels special to every customer, as they can get the interface of their interests. This cannot be possible without analyzing the data of customers, and this is where AI chatbots come into play. AI can analyze vast amounts of data and provide insights that can be used as a lead generation by the marketing team to offer financial plans according to customers’ interests. For example, a customer, while digital banking, scrolls through the insurance plans, and then it can be captured by the banking organization, and they can offer a few interesting and beneficial insurance plans for customers.

3) Feedback and surveys

Feedback is another important aspect that contributes to enhancing the industry, as it can only get through the real-world users. A banking organization cannot personally and manually call every customer to get their feedback, as this takes a lot of time. AI chatbots can easily run a survey at a certain time gap to check the customer’s experience in the form of feedback that helps the organization to work on weak points and make them better for next time. For example, a customer does a transaction, and then a pop-up appears on screen to ask for his/her experience of the transaction.

4) Customer Education

Educating customers is another form of impressing them and also enhancing their experience towards banking organizations. Manually educating customers about financial terms can be a time-consuming process and also has a high chance of inaccuracy. Where AI chatbots can easily educate customers with properly organized information. For example, if a customer wants to open an account, then AI-powered chatbots can easily educate them about the account types and their differences. This provides a great experience to customers in their initial interaction with the organization.

5) Automate essential banking activities

Activities like transactions, monthly bill payments, etc., can be an important process while doing digital banking. Generally, these are repetitive processes and can be automated using AI-powered chatbots. This saves time for customers and banking organizations too that enhance customer experience. For example, if a customer pays an electricity bill on a certain date of every month, then it can be set up in such a manner that the bill automatically pays on that date without bothering the customers.

Related Blog: AI Chatbots Solutions for Customer Service Automation

Challenges with AI-Powered Chatbots on Customer Experience in Banking

We have mentioned the benefits of AI-powered chatbots on customer experience in banking that are incredible in every manner. Now it’s time to look for some challenges that can affect the implementation and benefits. Here are a few challenges mentioned below.

-

- Misunderstanding customer queries can be an issue, as AI chatbots provide accurate answers when entering a prompt formally. But if a customer enters informal language, then there can be a high chance of getting inaccurate results.

-

- Overdependence on AI chatbots can be an issue for human employees, as they may get fear of losing a job that could result in a high unemployment rate.

-

- Language can be a barrier for many customers, as there can be a chance of not getting to know the language that customers know or vice versa.

Connect with us! Custom AI Solutions | AI Automation Agency in India

Final Words

AI-powered chatbots are always a tool that every organization or business wants to implement for taking care of their customer experience towards them. For the banking industry, AI chatbots have the greatest potential to enhance customer experience while doing digital banking or any other type of banking activities. It can offer high security of customer data, personalization, information, answers to queries, feedback, etc. This is also true that there are a lot of challenges while implementing an AI chatbot, like data integrity, overdependence, cost factor, language, etc., but they can be tackled with careful and planned implementation techniques. Overall, AI-powered chatbots can be the tool that changes customers’ expectations into reality while doing banking operations.

If you’re inspired to take the leap into AI chatbots solutions for customer service automation and need expert guidance, don’t hesitate to reach out to Aeologic Technologies. With a track record of delivering cutting-edge digital solutions, we’re here to assist you in making the right choice for your business.